Recently, Linglong Tire and General Science respectively issued announcements of expected increase in 2024 semi-annual performance. The profitability of the two companies has once again soared on the basis of last year's substantial growth.

In 2024, driven by the continuous growth in production and sales in the domestic automobile market and the strong demand in the overseas tire market, the tire industry remains prosperous.

Two listed tire companies saw a sharp increase in profits

Linglong Tire said in the announcement that it expects to achieve a net profit attributable to shareholders of the listed company of 850 million to 1.02 billion yuan in the first half of this year, compared with the same period last year, it will increase by 289 million yuan to 459 million yuan, a year-on-year increase of 52% to 82%.

It is expected that the net profit attributable to shareholders of the listed company after deducting non-recurring gains and losses in the first half of the year will be 840 million yuan to 990 million yuan, which will increase by 341 million yuan to 491 million yuan compared with the same period last year, a year-on-year growth of 68% to 98%.

The company's product sales have all increased, with cumulative sales in the first half of the year increasing by approximately 11% year-on-year, overall sales in overseas markets increasing by approximately 20% year-on-year, and sales of passenger car tires with higher gross margins increasing by approximately 12% year-on-year.

In 2024, Linglong Tire is actively upgrading its products and continuously carrying out structural adjustments in domestic and overseas retail and supporting markets. At the same time, the second overseas base has gradually released production capacity to provide support for the growth of production and sales in overseas markets. In addition, the company continues to promote cost reduction and efficiency improvement, and its profitability has been significantly improved.

General Science expects to achieve a net profit attributable to shareholders of the listed company of 270 million yuan to 300 million yuan in the first half of 2024, an increase of 364.86% to 416.51% year-on-year.

It is estimated that the net profit attributable to shareholders of the listed company in the first half of the year after deducting non-recurring gains and losses will be 260 million yuan to 290 million yuan, an increase of 479.60% to 546.47% year-on-year.

During the reporting period, GS actively seized the development opportunities of "domestic and international dual cycles" and relied on the advantages of the "overseas dual base" layout in Thailand and Cambodia to accelerate the layout of the global marketing network and the development of new businesses, accelerate the release of high-quality production capacity, and continuously improved the competitive advantage of its cost-effective products, the production and sales volume of tires achieved a significant growth in the first half of the year; At the same time, the company continues to promote quality and efficiency improvements, achieving significant improvements in profitability.

Supporting + export: Two drivers driving market growth

According to the latest data released by the China Passenger Car Association on July 8, the cumulative retail sales of the national passenger car market from January to June 2024 was 9.841 million vehicles, a year-on-year increase of 3.3%. Among them, new energy passenger vehicles still maintained a high growth trend, with cumulative retail sales of 4.111 million units from January to June, a year-on-year increase of 33.1%.

In terms of exports, the cumulative exports of passenger cars (including complete vehicles and CKD) from January to June 2024 were 2.247 million units, a year-on-year increase of 33%.

There is another very critical data, in June, domestic brand passenger cars accounted for 64.8% of the wholesale market share, an increase of 11.2 percentage points over the same period last year. This means that for every 10 cars sold in the Chinese market, more than 6 are domestically produced.

In contrast, mainstream joint venture automakers sold 496,000 vehicles, down 30% year-on-year, and luxury car wholesalers sold 267,000 vehicles, down 18% year-on-year.

According to the China Passenger Car Association's forecast, the cumulative retail sales of passenger cars nationwide are expected to exceed 22 million units in 2024, a slight increase from 21.699 million units in 2023.

If we calculate based on the 65% annual market share of domestic brands, of which 50% are original domestic tires, Chinese automakers will create approximately 28.6 million supporting demands (excluding spare tires) for Chinese tire brands in 2024.

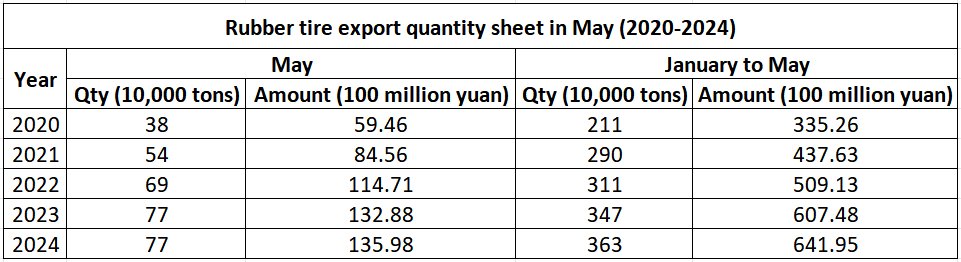

On the other hand, the export market continues to drive corporate performance growth. In the first five months of 2024, China's rubber tire exports reached 3.63 million tons, a year-on-year increase of 4.6%; the export value was 64.2 billion yuan, a year-on-year increase of 6.1%.

Among them, the export volume of automobile tires in January-May was 3.1 million tons, a year-on-year increase of 4.4%; the export value was 53 billion yuan, a year-on-year increase of 6.9%.

Overall, China's tire foreign trade market performed well in the first five months, achieving steady growth in both quantity and amount.

With the decline in costs such as shipping costs and raw materials, it is believed that the profit pressure on other tire manufacturers will be effectively alleviated in the first half of the year.

Replacement market underperforming

Although supporting and exporting are booming, the domestic replacement market remained quiet in the first half of the year. According to F6 Automotive Technology data, in May 2024, the output value of the automotive aftermarket fell by 3% year-on-year and 4% month-on-month; the number of vehicles entering the factory fell by 1% year-on-year and 2% month-on-month. In June, it declined again - the output value of the automotive aftermarket fell by 3% year-on-year and 3% month-on-month; the number of vehicles entering the factory fell by 1% year-on-year and 1% month-on-month.

At the same time, according to relevant surveys, the overall sales volume of the passenger car tire retail market continued to decline steadily in mid-June. Due to the hot summer, people's non-essential travel has decreased compared to last month. At the same time, the proportion of short-distance travel by electric vehicles and motorcycles has increased, resulting in a decrease in car usage.

Moreover, the May Day holiday had just passed, and June was the off-season for passenger car tire sales. In addition, people's consumption habits became more conservative and their willingness to go to stores was low, resulting in a month-on-month decline in sales. Maintenance demand at some comprehensive service shops increased, but tire replacement demand was flat. In the truck and bus market, overall sales volume in the terminal market also showed a downward trend. Long-distance transport capacity is still very scarce, and coupled with the impact of foreign wars, export shipping freight rates have risen, and some companies have reduced the volume of export orders, further exacerbating the situation of too many vehicles and too few jobs, so that there is no obvious increase in overall replacement demand after the warming up.

In addition, in June, parts of central China, north China and east China entered the wheat harvest season, and some car owners returned to their hometowns for the busy farming season, which increased the proportion of out-of-service vehicles to a certain extent.

At present, the domestic tire market is facing the dilemma of consumption downgrade and insufficient demand. Dealers should prepare stocks reasonably, maintain sufficient cash flow, and have firm confidence. China's growing car ownership means that tires are still a blue ocean market full of opportunities!

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as electron beam irradiation system, TBR bead winding system, tire uniformity rectifier etc., please feel free to contact info@delphygroup.com.