Passenger car and light truck tires

PC< September year-on-year

Global OE demand in October increased by +2% year-on-year. Among them, Europe +14% year-on-year, Central and North America -6% year-on-year, and China +1% year-on-year.

Global RE demand in October increased by +4% year-on-year. Among them, Europe -1% year-on-year, Central and North America +13% year-on-year, and China +14% year-on-year.

PC< January to September cumulative year-on-year

From January to October, the global OE market demand was +7% year-on-year. Among them, Europe +11% year-on-year, Central and North America +9% year-on-year, and China +4% year-on-year.

Global RE market demand from January to October was -1% year-on-year. Among them, Europe -5% year-on-year, Central and North America -2% year-on-year, and China +13% year-on-year.

PC< year-on-year for each month

The growth rate of the global OE market has slowed down since April, with a significant decline.

In particular, China's OE market has declined rapidly, with negative year-on-year growth again in June, Europe, Central and North America also experienced varying degrees of decline.

In Europe, there was a catch-up effect in demand after falling in September; In China, demand showed positive growth for the first time since May, driven by government subsidies and falling average car prices; The North American market was affected by strikes at OEMs, resulting in a significant slowdown in local demand.

The growth of the global RE market has slowed down significantly.

In Europe, demand in October was very close to 2022 levels for the first time this year, despite the impact of weak winter tire sales; In North America, demand maintains good momentum against the backdrop of economic resilience; In China, demand continues to grow and is returning to 2021 levels.

Truck and bus tires

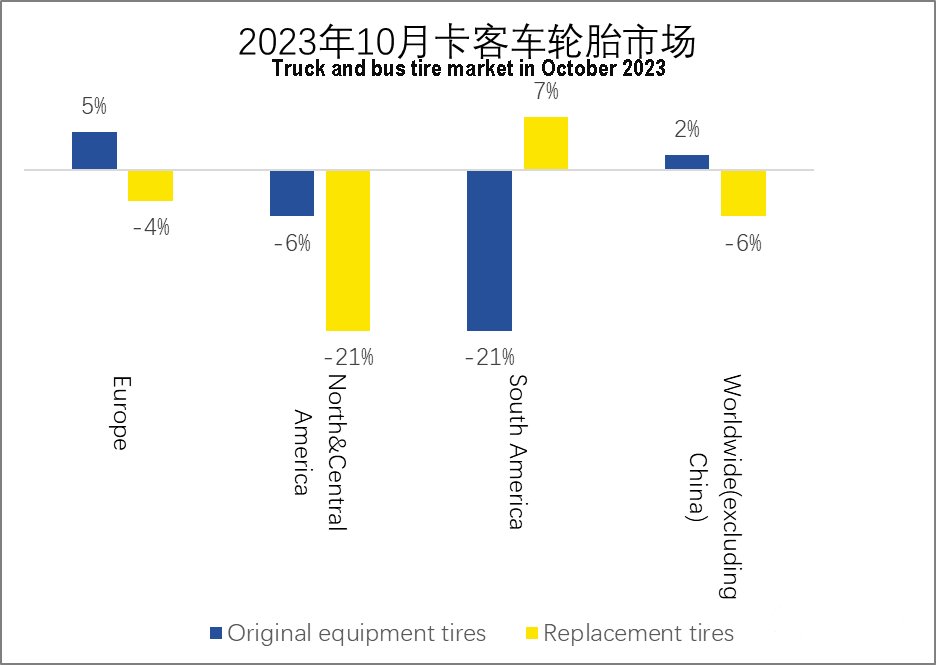

TBR&BIAS October year-on-year

Global (excluding China) OE market demand in October increased by +2% year-on-year. Among them, Europe +5% year-on-year, Central and North America -6% year-on-year, and South America -21% year-on-year.

The global (excluding China) RE market in October was -6% year-on-year. Among them, Europe -4% year-on-year, Central and North America -21% year-on-year, and South America +7% year-on-year.

TBR&BIAS cumulative year-on-year from January to October

From January to October, the global OE market demand (excluding China) increased by +2% year-on-year, with Europe increasing by 8% year-on-year, Central and North America -2% year-on-year, and South America -23% year-on-year.

From January to October, the global (excluding China) OE market was -6% year-on-year. Among them, Europe -9% year-on-year, Central and North America -17% year-on-year, and South America +7% year-on-year.

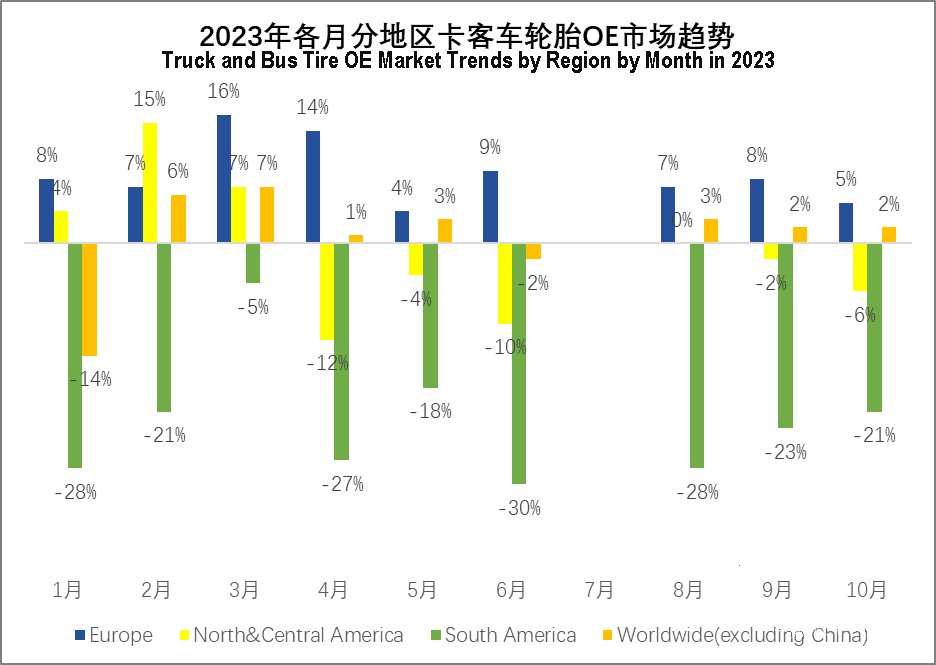

TBR&BIAS year-on-year for each month

The growth rate of the global OE market gradually declined after rapid growth in the first quarter, and showed a stable trend in the third quarter.

Demand from European and North American OEs remains high, especially in North America, while truck manufacturers have some ongoing difficulties with supply and access to labor, concentrated advance vehicle purchases have sustained demand as new greenhouse gas emissions standards take effect in 2024. The same situation will happen in South America at the end of 2022, and new anti-pollution standards will be introduced on January 1, 2023, leading to early purchases in 2022.

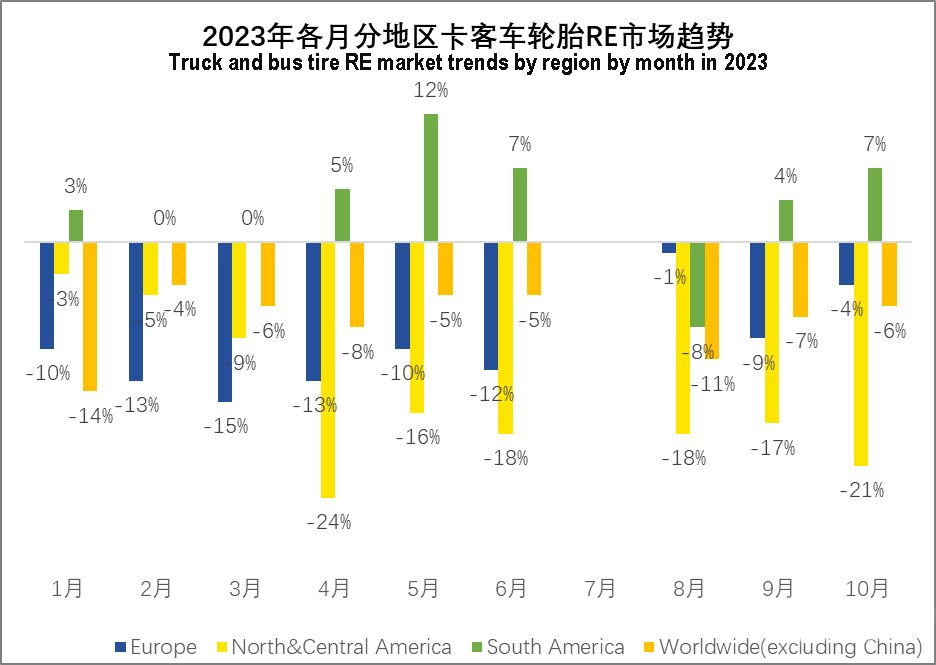

The global RE market remains stable.

European destocking is coming to an end and demand is gradually recovering; Destocking in North America will continue until the end of this year; In South America, demand remains at the level of previous months and continues to trend upward throughout the year.

DLFTECH is a professional equipment service company established by a senior marketing and R&D team in tire and rubber conveyor belt equipment industry. Leading by automation process equipment demand, the company is committed to the docking of intelligent equipment and technology, to achieve zero distance technique process and bring new profit growth points and continuous market competitiveness to customers. Among wordwide rubber machine anufacturers, DLFTECH has won the support and trust of more and more clients all over the world upon better reputation and better quality in tire making machine and conveyor belt equipment!

If any tire and conveyor belt industry customers need such as hydraulic tire vulcanization machine, hydraulic plate vulcanization machine, steel wire bead winding production line, Apxing line, etc., please feel free to contact info@delphygroup.com.