1. Changes in ranking companies

The China Tire Enterprise Ranking Activity has been held for eight times this year since it was organized in 2016, the first year of the “Thirteenth Five-Year Plan”.

A total of 52 domestic and foreign tire companies participated in the ranking activity in 2023. Intuitively, compared with 2022, when the number of ranked companies hit a record high, 13 companies exited and 4 companies were added, so there were 9 fewer companies.

Among the four new companies, Shandong Yousheng and Weihai Junle made their first appearance on the list. Tianjin Wanda "renewed its lead" after a gap of one year. In addition, Zaozhuang Mining (Group) Rubber Co., Ltd. The data of its three companies are consolidated and reported in the form of a group.

The 13 companies that have withdrawn from the rankings this year have different reasons for their withdrawal. Three companies, Shandong Chuanghua, Shandong Yuanfeng, and Qingzhou Lundao, which were reorganized and cooperated with China Industrial Zhongda Outai, did not fill in the data, and the number decreased by three. Shandong Zaokuang Zhongxing Huitong, Fengyuan Tire, and Bayi Tire were reported as a group, which decreased by two companies. Haian Rubber did not fill in the report due to planning for listing and financing (the company has currently suspended its IPO).

2. Changes in sales revenue

1) Changes in sales revenue of the overall list

The changes in sales revenue of China’s tire ranking companies from 2016 to 2023 are shown in Table 1.

As can be seen from Table 1, the sales revenue of domestic tire ranking companies in 2023 totaled 218.976 billion yuan, a decrease (year-on-year, the same below) of 4.98%.

2) China’s tire ranking among the “Top 10”

The entry threshold for the "Top 10" has dropped slightly, from 6.380 billion yuan in 2022 to 6.292 billion yuan in 2023.

From the perspective of industry concentration, the sales revenue of the "top 10" totaled 124.789 billion yuan, an increase of 5.55%, accounting for 56.98% of the total sales revenue.

Among the "Top 10", Zhongce, Sailun and Linglong rank among the top three. With 28.989 billion yuan, Zhongce Rubber Group has taken the lead. Sailun Group ranked second in the country with 21.519 billion yuan, and its annual revenue surged by 4.4 billion yuan. Linglong Tire ranks third with sales revenue of 17 billion yuan. Shuangqian Group ranked fourth with sales revenue of 10 billion yuan; Triangle Tire ranked fifth with sales revenue of 9.220 billion yuan. In the range of 6 billion to 8 billion yuan, there are five companies: Guizhou Tire, Pulin Chengshan, Xiamen Zhengxin, Double Star Group, and Sen Qilin. The revenue gap between the companies has not widened. With the acceleration of the construction of overseas production bases and the increase in production capacity release, ranking is full of uncertainty. Among them, Senqilin jumped 2 places, rising from 12th to 10th, making it into the top 10 for the first time.

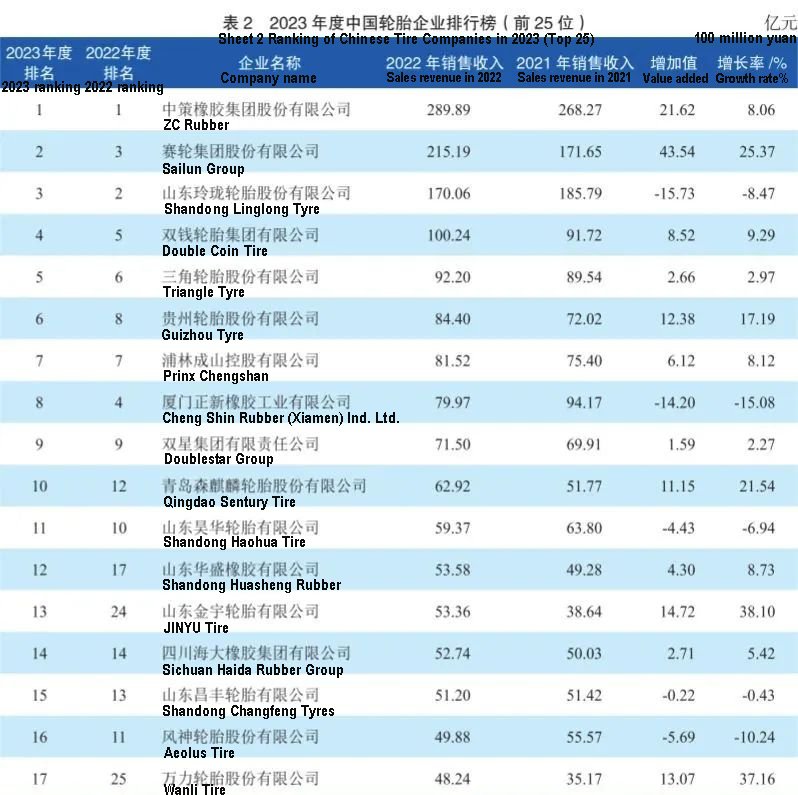

3) China’s tire ranking among the “Top 25”

The entry threshold for the "Top 25" has been raised to a higher level, reaching 3.517 billion yuan in 2022 and 3.8 billion yuan in 2023.

From the perspective of industry concentration, the sales revenue of the "top 25" totaled 195.064 billion yuan, an increase of 4.76%, accounting for 89.08% of the total sales revenue.

Among the "Top 25" companies, 6 companies have a growth rate of more than 15%. Sorted by growth rate from large to small, they are Chaoyang Langma, Jinyu Tire, Wanli Tire, Sailun Group, Senqilin, and Guizhou Tire.

Among the "Top 25" enterprises, 8 have an added value of more than 800 million yuan. Sorting from large to small in terms of added value, they are Sailun Group, Zhongce Rubber, Jinyu Tire, Wanli Tire, Guizhou Tire, Chaoyang Langma, Senqilin, and Shuangqian Tire.

Judging from the ranking changes, Jinyu Tire has made the biggest jump, jumping 9 places, from 24th last year to 13th this year; Wanli Tire has jumped 8 places, from 25th to 17th position; Chaoyang Langma and Huasheng Rubber jumped 5 places.

Among the eight companies in the "Top 25" that have achieved strong growth, Wanli Tire is the only one without overseas factories. Wanli Tire's production and sales have maintained high double-digit growth in the past three years. The remaining seven companies all have overseas factories, namely Zhongce Rubber, Sailun Group, Shuangqian Tire, Guizhou Tire, Sen Qilin, Jinyu Tire, and Chaoyang Langma.

The ranking of Chinese tire companies in 2023 (top 25) is shown in Table 2.

4) Overseas factory sales revenue

In 2022, the triple pressure of shrinking demand, supply shocks, and weakening expectations will be combined with the spread of the epidemic in many places. The domestic market will be affected by the slowdown in demand growth, the production of tire companies will be restricted, and the overall total tire supply will show a slight downward trend. Tire companies are seizing the domestic and international dual-cycle development opportunities, actively responding to the “Belt and Road” initiative, accelerating the release of production capacity, accelerating the layout of global marketing networks and the development of new products and new businesses, and deepening strategic cooperation with world-class customers.

The sales revenue of overseas factories of 10 Chinese tire companies is shown in Table 3.

As can be seen from Table 3, in 2022, the sales revenue of overseas factories of tire companies will be 32.898 billion yuan, with a growth rate of 32.32% and an added value of 8.036 billion yuan.Among them, the sales revenue of Sailun Group's overseas factories was 9.696 billion yuan, accounting for 30% of the sales revenue of the 10 overseas factories; the added value was nearly 2.2 billion yuan, accounting for 27% of the total added value. Three companies that "go global" late in building factories - Pulin Chengshan and Jiangsu General Overseas Factory, continue to promote the construction of new projects to fully meet market demand, with sales revenue growth rates of 61% and 88% respectively. Jinyu Tire Vietnam Factory accelerated the release of production capacity, and completed sales revenue increased by 7 times. In 2022, Guizhou Tire and Chaoyang Langma achieved "zero" overseas revenue breakthroughs, achieving sales revenue of 539 million yuan and 750 million yuan respectively.

5) Ranking of domestic tire companies in China in 2023

The ranking of domestic tire companies in China in 2023 (top 25) is shown in Table 4.

Table 4 is based on the tire sales revenue of all tire companies (including foreign-funded companies) with factories in mainland China in 2022. Therefore, this ranking can better reflect the situation of the tire market in mainland China in 2022.

As can be seen from Table 4, among the top 25 tire companies, only 8 companies experienced a decrease in sales revenue, while the remaining 16 companies (Tianjin Wanda Tire has no comparable data) all achieved growth.

3. Changes in product output

The output of China’s tire ranking companies from 2017 to 2022 is shown in Table 5.

Note: The total tire production statistics include some special tires, industrial tires, etc.

1) Analysis of production change factors in 2022

In 2022, affected by the severe domestic economic downturn and the impact of the epidemic, domestic tire production, sales and profits will be severely impacted, mainly reflected in the overall weakness of the original equipment of truck and bus tires and the entire tire replacement market.

(1)Tire matching has different effects

In 2022, the domestic passenger car OEM market will continue to grow rapidly, driven by policies such as the halving of purchase tax, new energy vehicles maintaining high growth, and good automobile export momentum, which will bring great benefits to supporting equipment and increase supporting volume 11 million units, which provides good support for the release of domestic semi-steel radial tire production capacity.

The production and sales of domestic commercial vehicle OEMs have both dropped sharply by about 31%. This is mainly due to the fact that all the previous policy incentives have been released, which has seriously overdrawn the market outlook and reduced the supply of all-steel radial tires by 10.6 million units. It is difficult to be optimistic in the short to medium term.

(2)Replacement repair market consumption drops sharply

Due to the weakening of investment in infrastructure, real estate, etc., road freight volume has been in negative growth for several consecutive months. The consumption of all-steel tire replacement and repair is extremely weak throughout the year. According to industry experts, it has dropped by more than 30% throughout the year.

Affected by the epidemic lockdown, rising prices of refined oil, limited income growth of residents, and weakening expectations, the consumption of semi-steel tire replacement and repair has declined significantly, with a summary of all aspects reflecting a drop of more than 20%.

(3)Total tire exports grow steadily

In 2022, the total export volume of automobile tires will be 7.107 million tons, an increase of 5.8%; the total amount will be $18.05 billion, an increase of 13.9%. However, looking at 2022, after falling by 5.3 percentage points in August, an inflection point for high export growth has appeared. Although the export of large engineering tires is relatively promising, other tire products have experienced significant declines.

2) Domestic tire production rankings

As can be seen from Table 5, there are 39 radial tire manufacturers among the 52 companies. Total radial tire production in 2022 will be 549 million units.

Among them, the total production of all-steel tires and semi-steel tires by the top 10 companies is approximately 309 million, accounting for 56.28% of the total production of 39 radial tire companies. The top 10 domestic production ranking companies in China in 2022 (total production of all-steel tires and semi-steel tires) are shown in Table 6. The top 10 companies in China's domestic factory production of all-steel tires and semi-steel tires in 2022 are shown in Table 7 and Table 8.

Note: Double Star Group Co., Ltd.’s output includes data from Kumho Tire’s three production bases in China.

(1)All-steel tire production

Among the 52 radial tire manufacturers, 38 are all-steel tire companies, and the total output of all-steel tires in 2022 was 120 million.

Among them, the total output of the top 10 all-steel tire companies was 61.7264 million units, accounting for 51.62% of the total output of the 38 all-steel tire companies.

(2)Semi-steel tire production

Among the 52 radial tire manufacturers, there are 34 semi-steel tire companies, and the total output of semi-steel tires in 2022 will be 429 million.

Among them, the top 10 semi-steel tire production companies produced a total of 261 million semi-steel tires, accounting for 60.84% of the total output of 34 semi-steel tire companies.

3) Tire production at overseas factories

The production status of overseas factories of Chinese tire companies from 2016 to 2022 is shown in Table 9.

With the commencement of the first phase of the Guizhou Tire Vietnam factory project in March 2022 with an annual output of 1.2 million all-steel tires; on March 28, 2022, the Chaoyang Langma Pakistan overseas joint venture factory project was completed. So far, my country's overseas factories have been completed and put into operation 10 families.

As can be seen from Table 9, the overseas radial tire production of Chinese tire companies has increased year by year. In 2022, the total radial tire production of 10 overseas factories was 59.381 million units, an increase of 5.77%. Among them, the output of all-steel radial tires was 16.0351 million units, an increase of 41.35%, a net increase of 4.69 million units, setting a new production record over the years; the output of semi-steel radial tires was 43.3459 million units, a decrease of 1.45 million units or 3.23% from the previous year.

4. 2024 ranking prediction

1) Domestic market

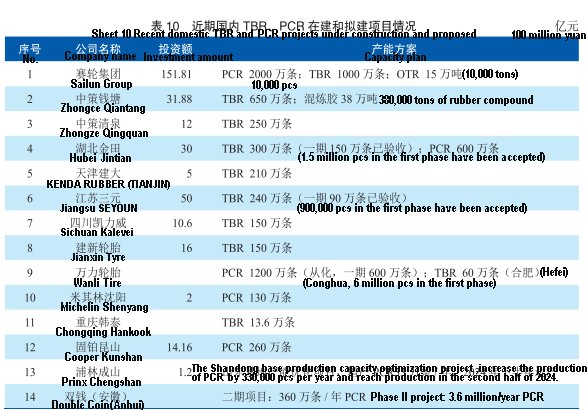

(1)PCR and TBR have become a "red ocean" of market competition

In recent years, domestic tire companies have increased their production capacity of passenger car tires and all-steel truck radial tires. In the post-epidemic era, the domestic market is not as good as expected, and the market competition in the tire industry, which already has overcapacity, is becoming increasingly fierce. With weak demand and rising costs, gross profit margins are getting lower and lower. The Matthew effect of "the strong gets stronger and the weak gets weaker" is becoming more and more obvious. In the past, orders were picked and made, but now, in order to ensure growth, orders are rushed to make.

Because of this, some announced domestic tire projects have slowed down the pace of construction and reduced the amount of investment. There are only a few projects that have been launched and closed, and most of them are intelligent transformation projects. The recent status of domestic TBR and PCR projects under construction and proposed is shown in Table 10.

(2)OTR and specialty tires become "blue ocean" markets

With PCR and TBR becoming the "red ocean" of market competition and sales becoming increasingly fierce, OTR and special tires are regarded as the next "blue ocean" market.

In 2021, my country's engineering machinery industry was maintained a high degree of prosperity. During the "14th Five-Year Plan" period, domestic investment and major projects have started one after another. With the steady promotion of my country's "new infrastructure" and the growth of investment in countries along the "Belt and Road", my country's engineering machinery industry continues to develop, and the downstream market prospects for engineering tires are good.

2) overseas market

From the perspective of investment areas, overseas factory projects are still growing unabated.

5. Conclusion

1) The technology, brand, quality, and channel advantages of leading companies are becoming more and more obvious.

Under the guidance of the national "double carbon" strategic goals, industry policies, and the exemplary guidance of leading enterprises, industry enterprises have embarked on a high-end, green, and intelligent development path.

2) National brands have ushered in the best era, and having "brand" but not "brand" will soon become a thing of the past.

With the rapid development of new energy vehicles, national tire brands continue to seize opportunities and improve quality. In terms of R&D and investment in new energy vehicle tires, national brands and foreign brands are basically on the same starting line and have opportunities for fair competition. The rapid growth in demand for tires due to high penetration rates, high performance requirements, strict supporting audit tests, and even greater replacement and repair market space behind them are all good news for independent brand tires.

At the same time, with the rise of national fashion brands, it has become a tide and trend. With the rapid changes and younger age of user groups, as well as the networked and convenient consumption methods, Chinese brands understand the market better, respond faster, and are easier to gain recognition from local consumers.

3) On the 10th anniversary of the “Belt and Road” initiative, the international influence of national tire companies has become stronger.

In the 10 years since the "Belt and Road" initiative was proposed, the footprint of my country's tire industry has developed from Southeast Asia, South Asia, and Central Asia to many countries and regions such as Africa and Europe. The cooperation has been fruitful. More than 10 tire companies have built overseas bases, exported a large number of high-end technologies and intelligent equipment, trained a large number of high-quality foreign production equipment personnel, and created tens of thousands of job opportunities.

At the same time, overseas projects have ushered in a period of peak production capacity release, becoming an important source of my country's product exports and the main pillar of economic benefits. It effectively avoids the impact of "double reverse" in the international market from the source, resolves the operating disadvantage of "both ends are outside" in the export market, enhances international competitiveness, and is expected to usher in a broader development space.

4) The "dual cycle" of the international and domestic markets is working together to promote the development of my country's tire industry.

The release of huge domestic tire production capacity and maintenance of competitiveness must rely on the joint efforts of the dual cycle of the international and domestic markets. Overseas markets account for almost 50% of the total production, and the profitability is relatively stable. Therefore, exports are crucial.

Deeply cultivating high-quality overseas markets and continuously expanding into vast emerging markets are important paths for independent brand tires to gradually move towards the center of the world.