As the world's third largest automobile market after China and the United States, India's tire industry has developed rapidly in recent years. Leading companies have begun to aim to replace Chinese tires and intensify their competition with Chinese brands.

Especially in the export market, India has continuously strengthened its brand building and high-end transformation, and stepped up its promotion efforts in Western markets such as Europe and the United States. India's tire exports have almost doubled in the past four years from Rs 12,000 crore to Rs 23,000 crore. So, how big is the gap between China and India's tire export industry?

China's export volume is more than 7 times that of India

On June 12, according to data released by ATMA, the total exports of the Indian tire industry in fiscal 2024 were 230.73 billion rupees, which was the same as the figure in the previous fiscal year.

Arnab Banerjee, Chairman of ATMA said: "Tire exports faced major headwinds in the first half of the fiscal year due to weak demand in Western countries, geopolitical tensions and rising inflationary pressures in global markets. However, tire exports rebounded sharply in the second half of the year, increasing by 12% year-on-year, highlighting the resilience of India's tire manufacturing industry under challenging conditions."

He pointed out that the quality and value proposition of Indian tyres are the key drivers behind the strong overseas demand.

The Indian tyre industry has an annual turnover of about Rs 90,000 crore and exports of over Rs 23,000 crore, making it one of the industries with the highest export-to-turnover ratio (about 25.6%) among the country's manufacturing sectors.

At present, China's export strength is more than one level ahead of India. According to data released by the General Administration of Customs, China's cumulative exports of rubber tires in 2023 reached 8.86 million tons, a year-on-year increase of 16%; the export value was approximately 155.812 billion yuan, an increase of 18.7% year-on-year. It can be seen that in terms of tire export value, China is more than 7 times that of India.

Exporting countries: India 170+, China 200+

ATMA said Indian tyres are currently exported to more than 170 countries across the world, with major markets including some of the most discerning markets in Europe and North America. The United States is the largest market for Indian tires.

In addition, India's tire exports to European countries such as Germany, France, the Netherlands and Italy also rank among the top.

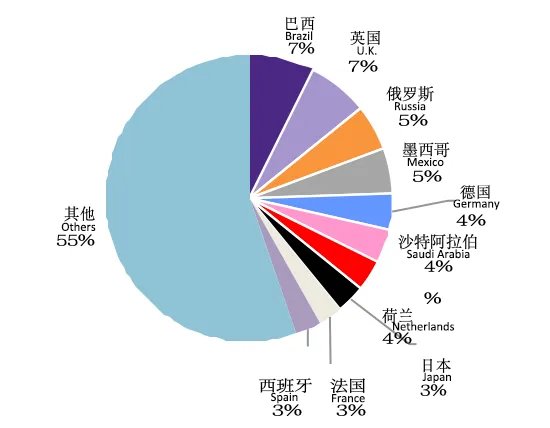

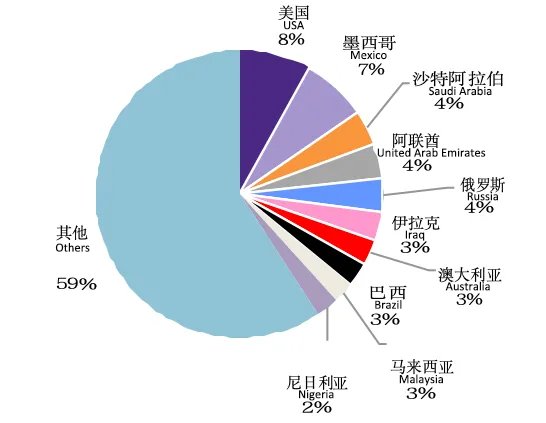

China's tire trading partners have reached more than 200. Judging from the distribution of tire exports in 2023, Brazil, the United Kingdom, and Russia account for a high proportion among semi-steel tire exporting countries (regions), while the United States, Mexico, and Saudi Arabia account for a high proportion among full-steel tire exporting countries (regions).

Statistics of China's semi-steel tire exports by country and region in 2023

Statistics of China's all-steel tire exports by country and region in 2023

In contrast, China's tire export regions are more evenly distributed and diversified, and have strong resilience against a reduction in imports from a single country.

Export challenges faced by both sides

As we all know, the biggest obstacle facing China's tire exports is the tariff issue; while the problem facing India is the shortage of natural rubber.

ATMA is calling for the removal of certain regulatory barriers surrounding natural rubber imports. Specifically, the association urged that the obligation period for natural rubber imports on tire exports be restored to 18 months from the current six months.

The association believes that the shorter time frame restricts operations and hinders the export competitiveness of tire manufacturers that are highly dependent on imported rubber.

At the same time, both sides face another challenge, which is their weak brand power. Chinese tire manufacturers have stepped up their investment in research and development and continuously introduced new products and technologies to shake off the "low-end" label; Indian tire manufacturers have achieved this goal mainly through acquisitions.

For example, Apollo Tyres, India's largest tire manufacturer, once wanted to go to the "high-end" through Dunlop, and then intended to acquire Cooper Tires of the United States and participate in the bidding for Kumho, but these ultimately failed. It eventually succeeded in purchasing the Dutch tire brand VREDESTEIN and operating it as a high-end brand.

Currently, ATMA has announced its 2030 plan, which is to promote India to become one of the world's top three tire centers by 2030.

Key to this plan is signing free trade agreements with major importing countries and working closely with automakers to increase exports of vehicles equipped with original Indian tires. While setting new benchmarks in manufacturing quality and driving innovation to meet the evolving demands of an ever-changing global market. The scheme targets tyre exports of over Rs 41,000 crore.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as electron beam irradiation system, TBR bead winding system, tire uniformity rectifier etc., please feel free to contact info@delphygroup.com.