As we all know, with the support of multiple favorable factors in 2023, tire companies basically made a lot of money last year, but this phenomenon no longer exists in 2024.

Although China's tire sales at home and abroad are generally strong, the continued rise in raw material costs and export shipping costs, coupled with the weakness of the all-steel tire market, has pulled down the profit level of the tire industry from its high level in 2023. By the second quarter, tire factories had to step up cost management and make every effort to achieve their full-year profit targets.

Raw material prices remain high

First, the prices of raw materials such as natural rubber and synthetic rubber have been rising since the beginning of the year, the comprehensive cost of tire raw materials in March has exceeded that of the same period last year. It is reported that as of June 7, the raw material cost index of all-steel tires was 13003.05, up 16.82% year-on-year.

According to industry insiders, the price of raw materials in 2023 fell by an average of about 7% compared to 2022, and the cost reduction for tire companies as a result should be between 10 and 12 billion yuan.

If the price of raw materials rises by more than 16% in 2024, the cost of the entire tire industry will increase by more than 20 billion yuan.

However, it is generally believed in the industry that the price of carbon black is replacing natural rubber and becoming the main factor affecting tire costs. Since 2024, carbon black prices have fallen in waves, curbing the overall increase in tire raw material costs.

Ocean freight rates soar in the off-season

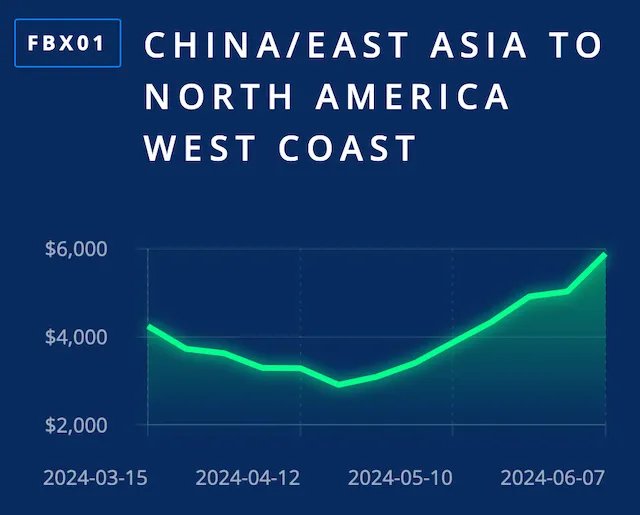

Amid ongoing geopolitical tensions in the Red Sea and the Middle East, global freight indices continue to rise, and a new round of shipping price increases has yet to see a turning point.

With the overall tight shipping capacity, the shipping market, which should have been in the off-season, has seen a surge in prices. Freight rates on routes to Europe and the United States have risen sharply, with the price even changing every day. Freight rates on some routes have skyrocketed by more than 50%.

As of June 10, the prices of sea freight containers from East Asia to the West Coast and East Coast of the United States climbed to US$5,888/40-foot container (FEU) and US$7,516/FEU, respectively, up 17% and 12% from the previous week.

The industry believes that the current increase in shipping costs depends on two factors: First, the duration of the Red Sea circumnavigation; Second, U.S. importers’ confidence in the economy and the extent and timing of their “restocking”.

Looking ahead, the industry expects that if the inventory replenishment cycle happens to coincide seamlessly with the traditional US peak season, this trend may continue until September.

Regarding this year's high shipping costs, many tire companies said that they have not been significantly affected, mainly because most of the company's overseas orders are based on the FOB model.

However, not being "significantly affected" does not mean that there has not been a significant impact. According to commodity trading rules, tire manufacturers are inevitably have to bear the profit compression caused by rising shipping costs.

According to the financial report of Nexen Tire South Korea in the first quarter of this year, freight expenses in the first quarter increased to 63.7 billion won, a year-on-year increase of 16%. Likewise, Kumho Tire's freight costs also rose 3 percent to 77.5 billion won during the same period.

An executive at a Korean tire company said: “Typically, tire companies sign freight contracts on an annual or biennial basis, so the recent spike in rates may not pose an immediate threat, but if uncertainty persists, it will hamper tire makers' overall profitability.”

Tire price hikes slowed down

In March, tire manufacturers issued price increase notices one after another following the rise in raw material prices and the order conference at the beginning of the year, marking the first wave of collective price increases in the industry this year.

In early April, the rise in raw material prices slowed down and domestic tire factories generally raised prices. Raw material prices were relatively stable in early May, but some factories continued to raise prices. With the decline in sales in the replacement market for passenger car tires and truck and bus tires in May, the bearish trend in prices intensified in June.

In this market situation where calls for price increases are gradually fading, some tire manufacturers have recently launched promotional policies, which will undoubtedly further squeeze corporate profits.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as rubber track curing press, tire mold intelligent laser cleaning system, hydraulic curing press for PCR/TBR, auto bead apex line, etc., please feel free to contact info@delphygroup.com.