Since the beginning of this year, commodities have fluctuated sharply, and rubber futures have also risen. It is understood that the price of natural rubber futures bottomed out and rebounded in early February, and rose to a high of 15,820 yuan/ton on March 19. Prices then began to fall until early May when they began to rebound.

Recently, rubber prices have once again broken through the high point in early April, approaching 16,000 yuan/ton. Part of this is due to supply and demand, but on the other hand, does it mean that natural rubber may break out of the ten-year cycle and start a global rise?

Thailand's rubber factories shut down in droves

According to Thailand's KKP Research Center, the Thai economy is in a weak state. From December 2022 to March 2024, the industrial production index continued to shrink for more than a year, setting a record for the longest continuous negative growth period.

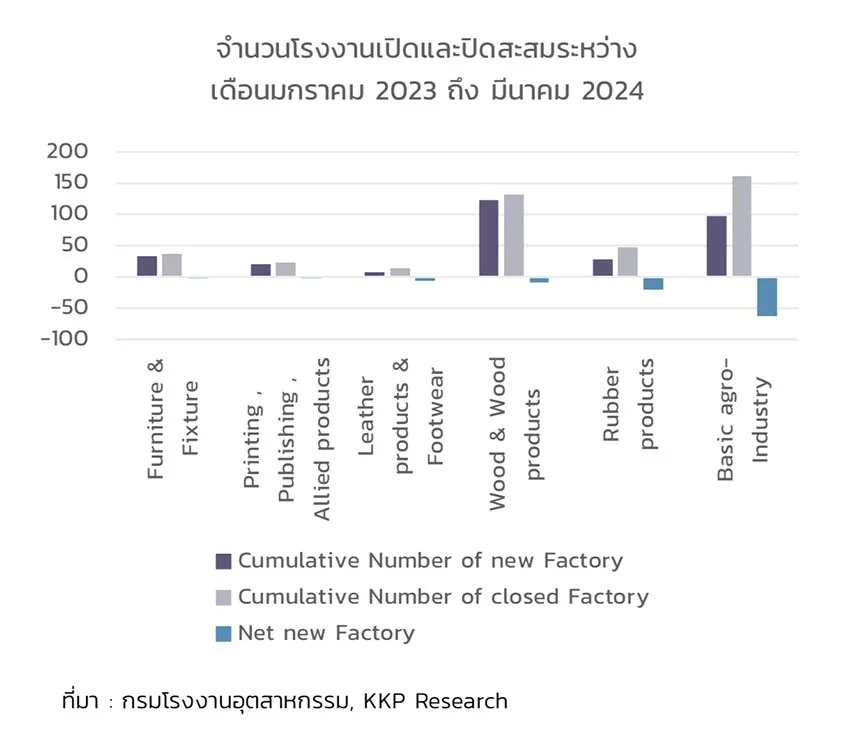

An average of 57 factories closed per month in Thailand in 2021, and an average of 83 factories closed per month in 2022. Starting from the second half of 2023, the number of factory closures rose to 159 per month. Overall, from the beginning of 2023 to the first quarter of 2024, more than 1,700 factories in Thailand have closed down, and more than 42,000 people have lost their jobs.

At the same time, the number of newly established factories is also declining, further reflecting the sluggish situation in Thailand's industrial sector. The number of newly established factories has slowed down significantly overall, from an average of about 150 new factories per month to just 50 per month.

Among them, the development of the rubber production industry is worrying due to production contraction and large-scale factory closures.

The data in the above figure shows that from January 2023 to March 2024, the cumulative number of new factories in Thailand's rubber production industry was less than 30; the cumulative number of factory closures was nearly 50, and the number of factories showed negative growth.

In terms of factory size and area, the closed factories are mainly large factories, while the newly opened factories are mostly small factories. This reflects that the past production slowdown was not caused by business factors; after all, the financial situation of small factories is often more fragile than that of large ones. The closure of large factories is a phenomenon driven by macro-structural factors that affect the entire industry.

The reasonable price range of natural rubber is 18,000 yuan/ton

In the past three years, the epidemic and other reasons have caused natural rubber to be at a loss and low price. Continuous blows to planting production among rubber plantations operators in natural rubber producing areas have caused the entire upstream to operate at a low level.

With the significant improvement in profits of the Chinese tire industry in 2023 and the continuous increase in demand for OE tires due to the explosion of electric vehicles in China, the stronger operating rate of China's tires, especially semi-steel tires, provided sufficient support and forward momentum for the upstream rubber supply chain to increase positions.

At present, domestic rubber futures prices continue to rise, which is also affected by the optimistic macroeconomic policy, the market generally expects that the Federal Reserve may start cutting interest rates in June. Domestic fiscal and monetary policies have also remained relatively loose, and commodities such as crude oil, copper, and precious metals have also performed relatively strongly recently, which has increased the valuation of rubber prices.

However, in the medium and long term, rubber is not optimistic. Although the output of some producing areas has declined due to factors such as aging trees, there is still a drive to increase production in some areas. At the same time, high-priced raw materials will also stimulate some additional output to a certain extent, and supply elasticity is expected to increase.

In the short term, the market is still in a stage with relatively few negative factors and is still viewed as relatively strong. It is generally believed in the industry that the reasonable price range of natural rubber is 18,000 yuan/ton.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as rubber track curing press, tire mold intelligent laser cleaning system, hydraulic curing press for PCR/TBR, etc., please feel free to contact info@delphygroup.com.