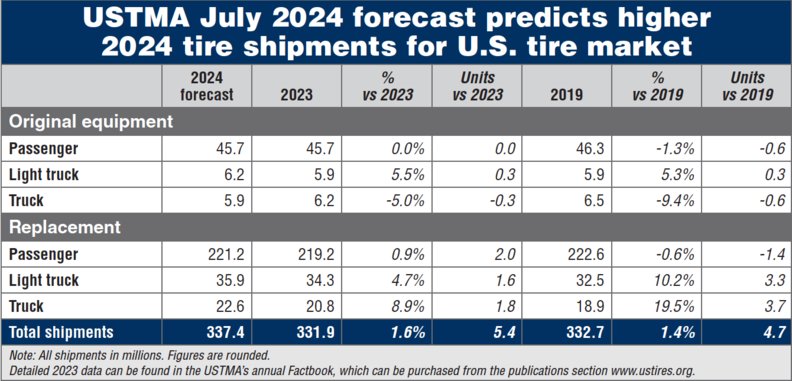

Buoyed by a healthy jump in replacement market demand for truck/bus tires, 2024 could turn out to be a record year for U.S. tire shipments, according to the latest data from the U.S. Tire Manufacturers Association.

The association expects total U.S. tire shipments to reach 337.4 million in 2024, compared with 331.9 million in 2023 and 332.7 million in 2019. At the same time, the predicted data also exceeded the record high of 335.2 million in 2021.

The biggest jump is expected in truck replacement tire shipments. The USTMA is forecasting demand of 22.6 million units in 2024, an 8.9-percent rebound from 2023, when shipments dropped 22.5 percent from 2022.

Replacement light truck shipments are slated to jump 4.7 percent, to 35.9 million units this year from 34.3 million units in 2023, while replacement passenger tire shipments, the largest category tracked, will remain relatively flat (221.2 million units this year versus 219.2 million units in 2023).

Compared with 2023, original equipment market shipments of passenger car, light truck and truck tires are expected to change by 0.0%, 5.5% and -5.0%, respectively, with total shipments basically the same as in 2023.

Replacement market shipments for passenger car tires, light truck tires, and truck tires are expected to increase by 0.9%, 4.7%, and 8.9%, respectively, for a total increase of 5.4 million tires.

Investment in the U.S. tire market will further increase in 2024. British tire manufacturer Enso plans to invest $500 million to build a factory in the United States.

The factory aims to produce 5 million electric vehicle tires by 2027 and create 600 jobs. When in full production, annual output will reach 20 million tires, accounting for 8% of the U.S. tire market and creating 2,400 jobs.

Chinese tire manufacturers Zhongce Rubber and Sailun Group have held groundbreaking ceremonies for their factories in Mexico. Both factories are designed to provide North America with a wide range of tire products.

In addition, South Korea's Nexen is still selecting a site for its U.S. factory, but the plan may be aborted because the cost of building a factory in the area is too high. However, the company said North America is still "under consideration."

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as hydraulic curing press for PCR/TBR, tire uniformity rectifier, bead winding machine etc., please feel free to contact info@delphygroup.com.