On July 18, according to the latest data released by the National Bureau of Statistics, China's rubber tire casing production in June 2024 was 93.4 million, an increase of 8.8% year-on-year. From January to June, the output of rubber tire casings increased by 10.5% year-on-year to 525.92 million.

Profitability of leading tire companies continues to rise

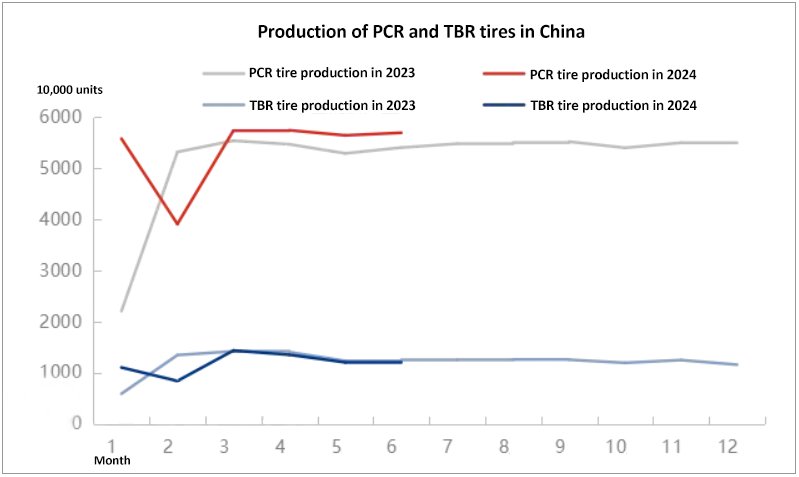

It is estimated that in June 2024, China's PCR tire production was 56.93 million, a slight increase of 0.90% month-on-month and a year-on-year increase of 5.37%; China's TBR tire production was 12.13 million, a slight increase of 0.92% month-on-month and a year-on-year increase of 3.04%. Tire production in June increased slightly from the previous month.

Currently, many tire factories have also reported good news about their performance. The profit levels of listed companies such as Linglong Tire, Sailun Group, and Sentury continue to improve.

Sailun Tire's profit from January to June exceeded 2.1 billion yuan, a year-on-year increase of 102.68% to 108.41%. Sentury Tire's net profit from January to June was between 1 billion yuan and 1.2 billion yuan. Linglong Tire expects its net profit from January to June to be between 850 million and 1.02 billion; General Science expects to achieve a net profit of 270 million to 300 million yuan in the first six months. Currently, the company's domestic and foreign PCR orders are in short supply, maintaining strong production and sales.

In the first half of the year, Linglong Tire's product sales increased, with cumulative sales increasing by approximately 11% year-on-year. Overall sales in overseas markets increased by approximately 20% year-on-year, and sales of passenger car tires with higher gross margins increased by approximately 12% year-on-year.

Tire factories around the country performed well

In addition to listed companies, tire factories across the country have also announced their first-half performance.

From January to June 2024, Yanchang Rubber sold 3.5379 million tires, a year-on-year increase of 27.16%. Especially in the foreign trade market, a total of 2.3335 million tires were exported, an increase of 42.2% year-on-year.

In the first half of 2024, Haid Group achieved full production and sales of PCR, TBR, and bias-ply products, with sales revenue increasing by 21.50% year-on-year and output value increasing by 25.11% year-on-year. By the end of the year, the company's production capacity is expected to reach 13 million pieces.

From January to May, Wanli Tire achieved a year-on-year growth of 11% and 9% in production and sales respectively, and a year-on-year growth of 9% in operating income, achieving "accelerated" production and operation.

Recently, local media also reported that Anhui Jichi Tire is in short supply of tires amid the recovery of global tire market demand and strong domestic tire demand. Its production capacity for next month has been fully booked and it is considering expanding production.

Haohua Tire achieved sales revenue of 2.7 billion from January to May 2024, a year-on-year increase of 7.5%. The company's orders have been scheduled for three months later. Shandong Hongsheng Rubber's overseas orders have increased significantly this year, with a total of 11 million foreign trade orders, and orders are currently scheduled until August.

Tire market is in the amalgamation of ice and fire

However, the performance of the tire industry in the first half of 2024 was differentiated. PCR tires maintained a "strong production and sales" trend, while TBR tires showed certain pressure in both domestic and foreign sales, and production and sales were weaker than the same period last year.

Monitoring data show that PCR tire companies have been in a state of supply exceeding demand in the first half of the year. The focus of production scheduling has shifted to foreign trade, and the shortage of conventional specifications for domestic sales continues.

However, in terms of TBR tires, the company's overall output was lower than the same period last year. However, in the second quarter, export orders shrank, domestic replacement market demand was sluggish, and corporate inventories gradually came under pressure. In order to ease inventory pressure, some companies flexibly controlled production, resulting in overall output lower than the same period last year.

Looking ahead to the second half of the year, the industry predicts that PCR tire manufacturers may continue the high production trend in the first half of the year, foreign trade orders will be relatively sufficient, the overall operating level of TBR tire companies will remain relatively stable, and the overall output is expected to be higher than the first half of the year.

In terms of tire prices, the first half of the year was relatively strong. The prices of major raw materials such as natural rubber and synthetic rubber rose sharply, and tire costs increased by nearly 10%. It is expected that in the second half of the year, the cost of raw materials may weaken, but it will still provide certain support to tire prices in the short term.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as electron beam irradiation system, tire laser engraving machine, green tire separant automatic sprayer, etc., please feel free to contact info@delphygroup.com.