According to relevant data, in June 2024, China's heavy-duty truck market sold about 74,000 vehicles (invoicing basis, including exports and new energy vehicles), a month-on-month decrease of 5% and a year-on-year decrease of 14%.

In total, In the first half of the year, China's heavy-duty truck market sold about 507,000 vehicles of various types, up 4% from the same period last year, a net increase of nearly 20,000 vehicles, and the cumulative growth rate further narrowed compared with January to May.

Although the heavy truck market has recovered slightly in the first half of the year compared to the same period last year, the overall environment is still sluggish. Can it reverse the trend and achieve growth in the second half of the year? At the same time, the all-steel tire market has been lukewarm, so what will be its future trend?

Heavy truck market falls short of expectations

Analysts believe that there are several characteristics of the heavy truck industry in June that are worth noting. First, according to data from the National Bureau of Statistics, in June, the PMI of the manufacturing industry remained the same as the previous month at 49.5%. The prosperity of the manufacturing industry is below the boom-bust line, and the heavy truck industry in it also showed "fatigue".

Judging from the sales trend of the heavy-duty truck industry in 2024, since the second quarter, the sales of heavy-duty trucks have been declining month by month, and the sales in June have further declined after May--The monthly result of 74,000 vehicles was only higher than the market performance in February of this year. It can be seen that market demand was weak in the second quarter.

In the dealer interview survey, many leading dealers pointed out the current situation of reduced demand in the logistics market, lower freight rates and shortage of supply in the second quarter, which shows the heavy pressure on the heavy truck industry in the second quarter.

At the same time, domestic heavy-duty truck invoice sales in June were higher than actual terminal sales. In fact, unlike April and May when the industry focused on digesting inventory, June was the month when channel inventory increased. The driving force behind this is that some heavy-duty truck companies rushed to achieve their half-year sales targets in the last month of the first half of the year, resulting in wholesale sales exceeding terminal retail sales.

According to industry insiders, domestic heavy-duty truck terminal sales in June are expected to decline by more than 12% year-on-year, and the demand for new vehicle purchases in the road freight industry is not optimistic.

On the other hand, the sales volume of heavy trucks in June 2024 was only higher than the same period in 2022, which shows that the recovery of the heavy truck market still requires more external stimulation.

The all-steel tire market is recovering slowly, it is still difficult

Similar to the heavy truck market, the current all-steel tire market is still in a difficult situation. According to relevant estimated data, in June 2024, China's all-steel tire production was 12.13 million, a month-on-month increase of 0.92% and a year-on-year decrease of 3.04%.

At the same time, the capacity utilization rate of China's all-steel tire sample enterprises was 60.51% in June, up 0.58 percentage points from the previous month and down 3.20 percentage points from the same period last year. The sales pressure on enterprises remained unchanged during the month.

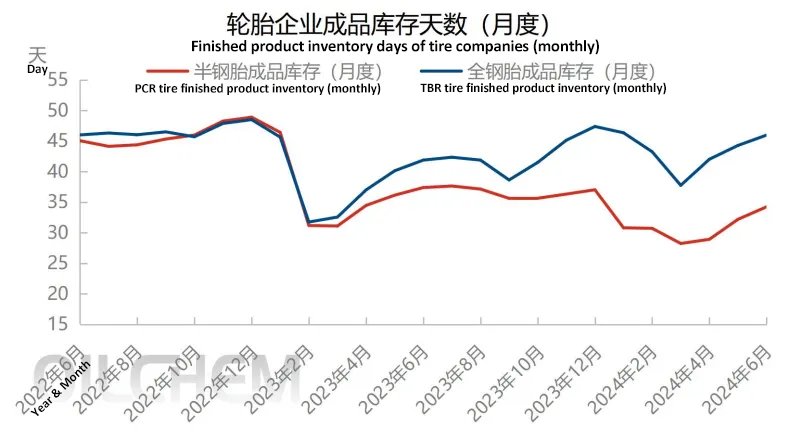

Although some companies strictly control production and have short-term maintenance plans during the Dragon Boat Festival, the actual shutdown time is less than last month. Overall, the capacity utilization rate is slightly higher than last month. Domestic shipments were flat during the month, and overall exports performed well, but shipping and container issues continued to plague market shipments, and overall inventories were high.

In addition, in June, the finished product inventory of Shandong tire sample companies continued to rise month-on-month, and the average inventory turnover days of all-steel tire sample manufacturers was 45.97 days, an increase of 1.69 days month-on-month and 4.09 days year-on-year.

In the replacement market, sales volume of truck and bus tires in the retail market showed a downward trend in June. Although it has entered the hot summer, the long-distance transportation capacity is still very scarce. In addition, due to the impact of foreign wars, the export shipping freight has risen, and some companies have reduced the export order volume, further exacerbating the situation of too many vehicles and too little work, so that the overall replacement demand has not increased significantly after the temperature rises.

In addition, in June, parts of central China, north China and east China entered the wheat harvest season, and some car owners returned to their hometowns for the busy farming season, which increased the proportion of out-of-service vehicles to a certain extent. Overall, the overall sales volume in the terminal market this month showed a downward trend.

It can be seen that whether it is production or inventory, or capacity utilization and terminal sales, the current all-steel tire market is still under great pressure.

Three major market opportunities in the second half of the year

From the perspective of heavy trucks, in the market segments, new energy vehicles, gas vehicles and exports continue to maintain growth momentum and remain popular. First, it is expected that the sales volume of natural gas heavy trucks in June will increase by about 30% year-on-year, a significant narrowing of the growth rate from May, and the terminal penetration rate may be close to 40%.

Secondly, the growth of new energy heavy-duty trucks exceeded expectations. It is expected that the growth rate of new energy heavy-duty trucks will continue to double in June, and the terminal sales volume may exceed 5,500 units, a slight increase from May.

In 2024, new energy heavy-duty trucks maintained a strong momentum, with a growth rate exceeding the industry's previous expectations. After June, new energy heavy-duty trucks achieved another "17 consecutive increases" year-on-year, and it is optimistically expected that the annual sales of new energy heavy-duty trucks will exceed 50,000 units.

The "turning point" of the accelerated development of new energy heavy-duty trucks is undoubtedly just around the corner, and this market segment has also received more and more attention and investment from brands and capital. In the second half of the year, it is expected that new energy heavy-duty trucks will continue to create new records, and this market segment is full of potential.

In addition, exports continued to maintain year-on-year growth in June and are expected to increase slightly year-on-year. According to relevant surveys, more and more established dealers choose to expand overseas markets as an increase. From a regional perspective, non-Russian regions such as Southeast Asia and Latin America have seen significant growth.

Compared with the driving factors in 2023, the growth of the heavy truck industry in 2024 has changed slightly. Looking ahead to the second half of the year, on the one hand, gas vehicles, new energy and exports are still attracting much attention. On the other hand, with the changes in the freight environment, there are more new demands in the fuel market such as trucks.

The market is changing faster and more complex, which has also brought new requirements and challenges to the tire industry. Practitioners should pay close attention to upstream and downstream industry trends and accurately grasp market opportunities.

DLFTECH is a professional equipment marketing & service company built by a senior R&D and marketing team in the tire & conveyor belt equipment industry. Benefiting from the rapid follow up of the international rubber industry's process re-engineering and the demand for industrial intelligence, DLFTECH, the best of the best, has rapidly developed into a new star in the international rubber machinery industry.

If any tire or conveyor belt industry customers need such as rubber track curing press, tire mold intelligent laser cleaning system, hydraulic curing press for PCR/TBR, etc., please feel free to contact info@delphygroup.com.