The latest data from the General Administration of Customs show that in November this year, China's rubber tire exports 760,000 tons, up 34.6% year-on-year, an increase of 50,000 tons.

From January to November, China's rubber tire exports totaled 8.12 million tons, up 16.4% year-on-year.

This year, China's tire export market is hot, in addition to the "Belt and Road" initiative continues to promote, tire companies overseas market development opportunities are more broad.

Overseas market demand recovery to good superimposed on domestic tires are more and more recognized by foreign consumers, the domestic tire companies have stared at the overseas market this piece of "big fat meat", have opened the pace of plant expansion.

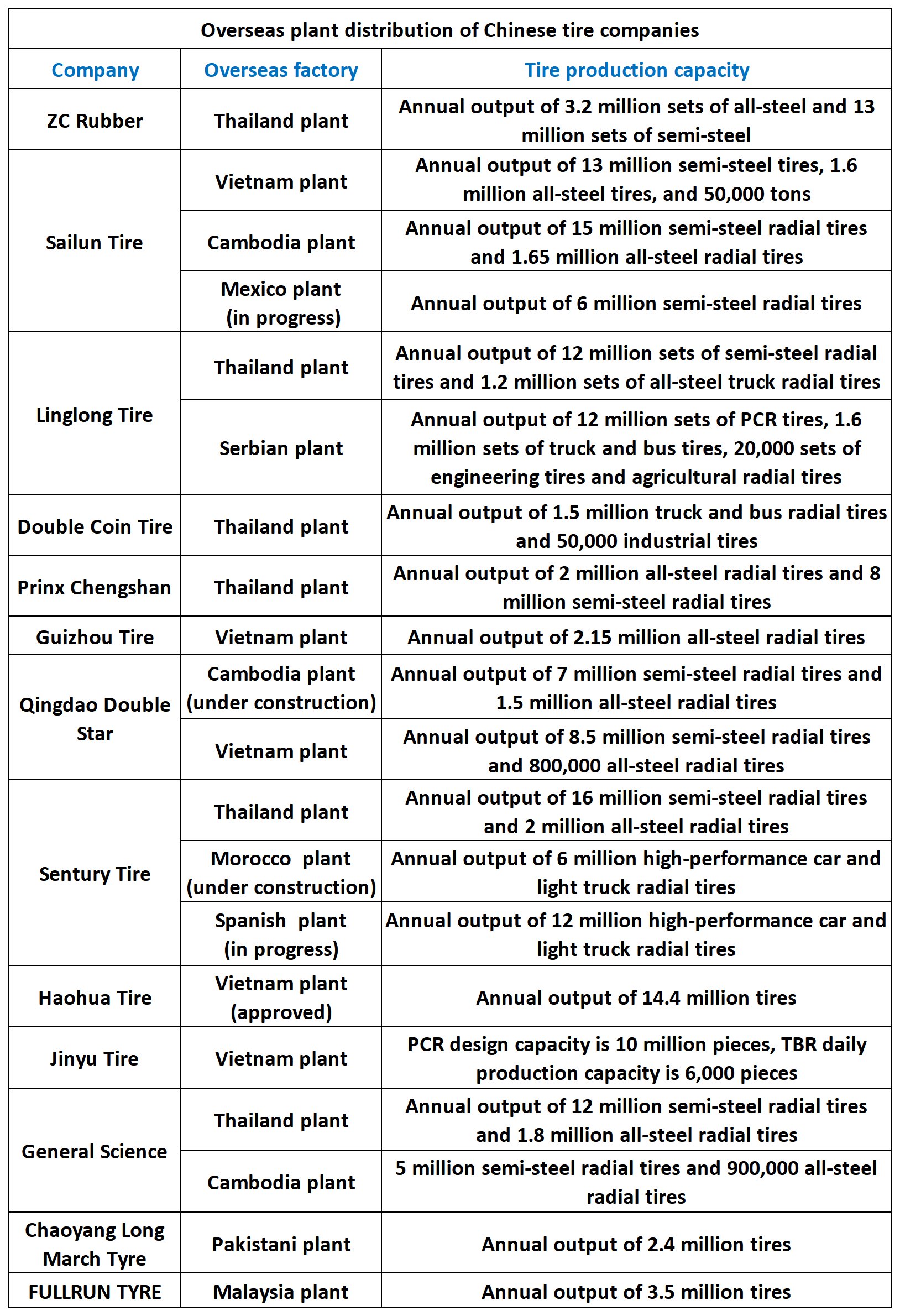

Domestic tire companies have layout overseas

At present, a number of domestic head enterprises have been in overseas expansion of production capacity, the following are relevant statistics on the overseas production capacity layout of tire companies.

Thailand Tire Plant

Due to the superior geographical location, advantageous manpower conditions, government preferential policies and other support, Thailand has many advantages and potential in attracting Chinese investment, in recent years, more and more Chinese tire companies choose to build factories in Thailand.

ZC Rubber Thailand Plant

ZC is counted as one of the earlier batch of Chinese tire companies to open factories in Thailand. on June 29, 2015, the ZC Thailand factory with a total investment of 24 billion baht was officially opened, which became ZC's first overseas factory, and then ZC built the second and third phases, and the ZC Thailand factory has become the most profitable tire factory of ZC.

Linglong Tire Thailand Plant

Linglong Thailand Plant is also the first overseas production base of Linglong Tire, which is an important part of its "7+5" global strategic layout, including an annual output of 12 million sets of high-performance semi-steel radial tires and 1.2 million sets of all-steel radial tires.

Double Coin Tire Thailand Plant

Double Coin's Thailand plant officially started production in 2017, and the first test tire rolled off the production line on June 30th of the same year. The factory is located in the Rubber Industrial Park in Rayong Province, Thailand, with a factory construction area of 30 hectares, and its products are mainly exported to the U.S. market.

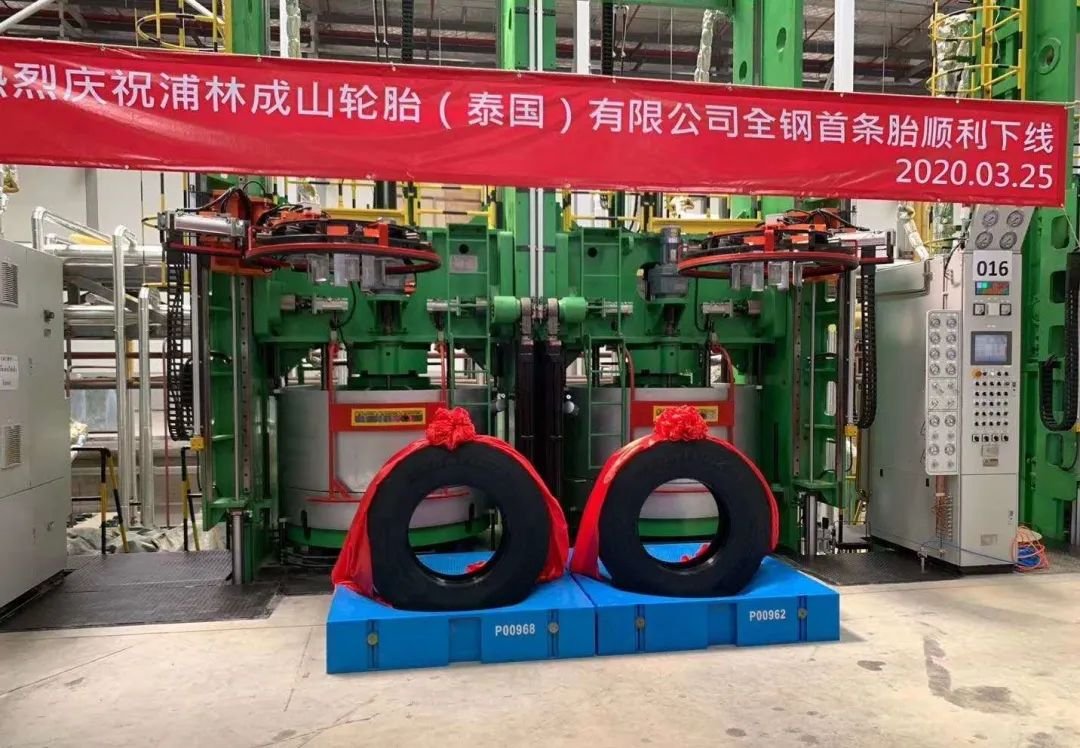

Prinx Chengshan Thailand Plant

In March 2019, Prinx Chengshan started construction of its Thailand plant, with the first phase of the project coming on stream in the second quarter of 2020, which will have an annual capacity of 800,000 all-steel radial tires and 4 million semi-steel radial tires.

In the second half of 2020, Prinx Chengshan initiated the second phase of the expansion of its production site in Thailand, which has reached production in 2022.

Sentury Thailand Plant

In 2015, Sentury invested in a 4.0 factory in Thailand, which became the world's most automated, intelligent and informatized factory in the tire industry at that time after it was put into operation.

In August of this year, the second phase of the intelligent factory in Thailand was put into production, adopting the intelligent manufacturing system developed by Sentury, which has increased the production efficiency by about 20% compared to the first phase of the factory, and the defective rate of the products has also decreased by about 30%.

The designed annual capacity of the second phase plant is 6 million high-performance semi-steel radial tires and 2 million high-performance all-steel radial tires. Currently, the plant's capacity utilization rate has reached 95%.

General Science Thailand Plant

The Thailand plant is also GS's first overseas production base. The first phase of the project was invested and constructed in 2019 and officially put into production in January 2020, it is the first step in GS's global layout.

In September this year, the second phase of the General Thailand project held a groundbreaking ceremony, with a total investment of 1.884 billion yuan, and a planned capacity scale of 6 million semi-steel radial tires and 500,000 all-steel radial tires, the project is expected to add an average annual operating income of 2.130 billion yuan, and an average net profit of 373 million yuan per year after the project reaches production.

In recent years, with the "Belt and Road" policy orientation and other multiple political factors, as well as economic reasons, China's tire companies to the Southeast Asian market layout to speed up, in addition to Thailand, Vietnam, Cambodia and other countries have also become a popular investment in domestic tire companies.

Vietnam and Cambodia Tire Plant

Sailun Tire Vietnam and Cambodia Plant

Sailun Tire Vietnam factory is the first overseas factory invested by a Chinese tire enterprise in 2012. 2013, Sailun Vietnam factory put into production of semi-steel radial tires, and in 2015, the production line of all-steel radial tires and off-highway tires was also put into production.

In November this year, the first tire of Sailun Vietnam factory's giant tire was officially launched, which is the first giant tire project in Vietnam's history, and Sailun has also become the first Chinese tire enterprise investing in the construction of giant tire project overseas.

In addition, in 2018, Sailun and U.S. Cooper also established an overseas factory in Vietnam in a joint venture.

In 2022, Sailun Cambodia plant with an annual production capacity of 9 million semi-steel tires project was officially put into operation, and the annual production capacity of 1,650,000 all-steel tires project was fully completed.

Guizhou Tire Vietnam Plant

Vietnam plant is the first overseas plant of Guizhou Tire, in April 2021, the plant's annual output of 1.2 million all-steel radial tires, the first tire off the line, so Guizhou Tire to achieve the domestic and foreign "dual-base" "international" production model.

Qingdao Double Star Vietnam and Cambodia Plant

On October 15, 2021, Qingdao Double Star announced the completion of its capital increase in Kumho Tire Vietnam. After the completion of the capital increase, Hong Kong Double Star holds a 42.41% stake in Kumho Vietnam.

For better global production deployment, Kumho Tire and Qingdao Double Star jointly invested 1.9 billion yuan to expand the capacity of Kumho Tire Vietnam plant.

In addition, in May this year, Double Star Cambodia plant groundbreaking, is scheduled to be completed by the end of this year and put into operation, according to foreign media reports, Double Star Cambodia production of tires, more than half will be shipped to the U.S. market.

Jinyu Tire Vietnam Plant

In December this year, Jinyu Tire Vietnam Plant held a groundbreaking ceremony for the PCR project, after five years, Jinyu Tire Group restarted the PCR business again.

The overall design capacity of the project is 10 million pcs, constructed in three phases, with the first phase of 3 million pcs expected to reach production in 2025.

This PCR construction is an expansion project of Jinyu (Vietnam), the Jinyu Vietnam factory was settled in Vietnam in 2020, and the daily production capacity of TBR has already reached 6,000 pcs.

Haohua Tire Vietnam Plant

Haohua Tire Vietnam factory is currently under construction. This year, Shandong Haohua Tire chose to build a tire manufacturing plant in Sikico Industrial Park, Minh Hung, Vietnam. At present, the project has been granted an investment license by the People's Committee of Binh Phuoc Province of Vietnam.

It is reported that the project, with a total investment of RMB 3.5 billion, will manufacture semi-steel radial tires and all-steel radial tires for automobiles and other vehicles, with an annual production capacity of 14.4 million sets, and an average annual production value of US$770 million.

In addition to the above overseas factories, there have been put into production Linglong Serbia plant, the Chaoyang Long March Tyre Pakistan plant and the construction of the Sentury Morocco plant and is advancing the Spanish plant.

Based on domestic, international, tire companies go out has become the inevitable trend of the domestic head of the tire business, from the tire industry global development pattern, the "Belt and Road" along the route is becoming a tire business investment layout of the "new continent".

DLFTECH is a professional equipment service company established by a senior marketing and R&D team in tire and rubber conveyor belt equipment industry. Leading by automation process equipment demand, the company is committed to the docking of intelligent equipment and technology, to achieve zero distance technique process and bring new profit growth points and continuous market competitiveness to customers. Select DLFTECH, so you have the best solution, always!

If any tire or conveyor belt industry customers need such as rubber track equipment, intelligent laser cleaning system for tire mold, hydraulic curing press for PCR/TBR, bead wrapping machine, etc., please feel free to contact info@delphygroup.com.